Calculate my payroll deductions

Subtract 12900 for Married otherwise. If youre checking your.

Standard Deductions Youtube

Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business.

. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross wages each pay period. Taxable income Tax rate based on filing status Tax liability.

Get Instant Recommendations Trusted Reviews. For example 40 hrs. Here When it Matters Most.

Ad Compare This Years Top 5 Free Payroll Software. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Best Online Payroll Tool.

Ad Get Access To Unlimited Payrolls Automatic Tax Payments Filings and Direct Deposit. Ad Top Quality Payroll Calculators Ranked By Customer Satisfaction and Expert Reviews. Convert the MONTHLY cost into a PER PAYROLL cost.

Adjusted gross income - Post-tax deductions Exemptions Taxable income. Here are some other possible deductions from employee pay you might need to calculate. Heres a step-by-step guide to walk.

Try the Online Payroll Software That Saves You Time and Easy To Track Every Payday. The first step is the easiest as all that you need to do is multiply the employees hours worked by his or her hourly rate of pay. The calculator is updated with the tax.

How to calculate annual income. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. In this example payroll is done biweekly.

Withhold 62 of each employees taxable wages until they earn gross pay. It will confirm the deductions you include on. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction.

Use this calculator to help you determine the impact of changing your payroll deductions. In 2023 these deductions. It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

Free Unbiased Reviews Top Picks. Usage of the Payroll Calculator. 52 weeks per year every 2.

Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. For example if an employee earns.

The Fonds de solidarité FTQs shareholders will receive 15 in tax credits from the Québec government and. Therefore we know there are 26 payrolls per year. Everything You Need For Your Business All In One Place.

You can enter your current payroll information and. Subtract the amount of the deduction from the wages after you calculate and deduct all of the payroll taxes. Post-tax deductions are a bit simpler to calculate.

The calculated amounts are estimates that can vary according to your tax situation. You can use the calculator to compare your salaries between 2017 and 2022. For example if you earn 2000week your annual income is calculated.

Ad Compare This Years Top 5 Free Payroll Software. Deductions for employee contributions to health plan coverage. Fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right.

See 2022s Top 10 Payroll Calculators. Rules for calculating payroll taxes. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

Free Unbiased Reviews Top Picks. 2022 Federal income tax withholding calculation. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Ad Payroll Done For You. Customized Payroll Solutions to Suit Your Needs. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Calculating Payroll Deductions In Canada Humi Blog

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Solved W2 Box 1 Not Calculating Correctly

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate Net Pay Step By Step Example

Mathematics For Work And Everyday Life

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Your Easy Guide To Payroll Deductions Quickbooks Canada

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Payroll Tax Deductions Monster Ca

Financial Literacy Gross Pay Payroll Deductions Net Pay 8th Grade Math Youtube

Payroll Calculator With Pay Stubs For Excel

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Different Types Of Payroll Deductions Gusto

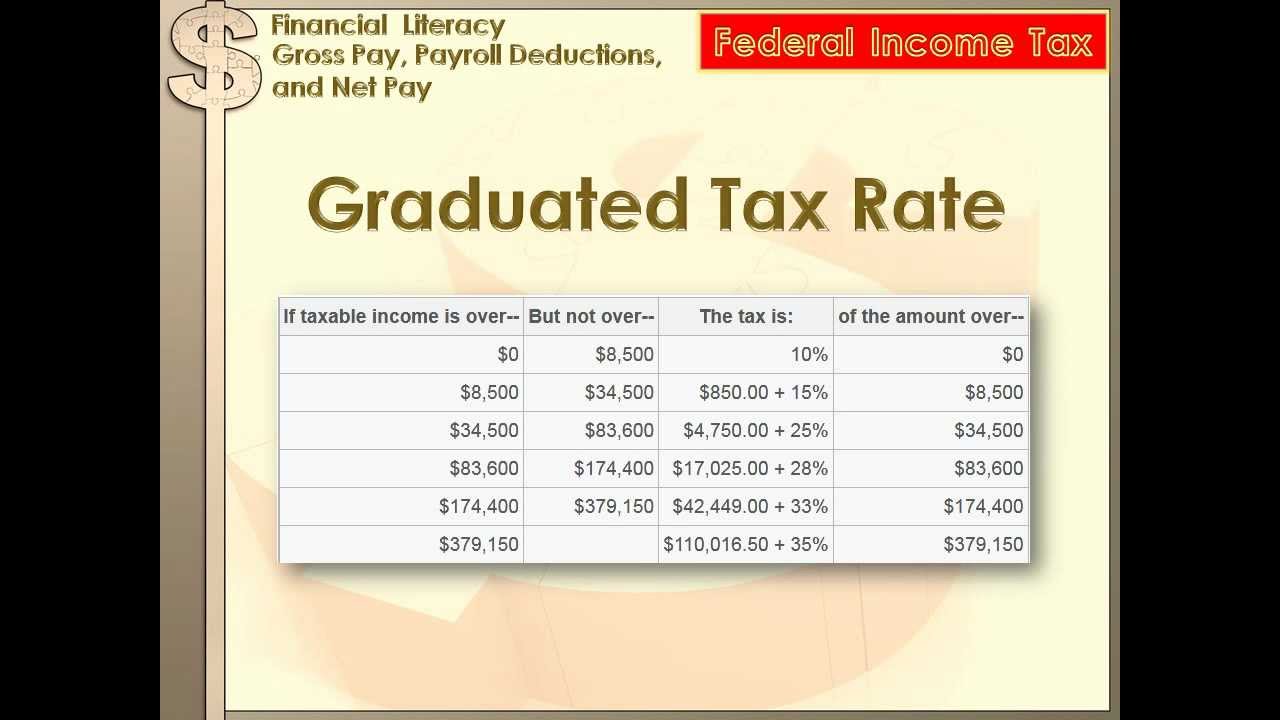

Federal Income Tax Fit Payroll Tax Calculation Youtube

Mathematics For Work And Everyday Life

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting